maryland digital advertising tax bill

Effective March 14 2021 the Maryland sales and use tax applies to the sale or use of a digital product or a digital code. Hogan Vetoes Maryland Digital Advertising Tax Legislation.

New Maryland Sales Taxes On Digital Products Computer Software E Books E Music Some Webinars And More Are You Up To Date Maryland Association Of Cpas Macpa

Maryland Digital Advertising Tax Amendment Bill Passes Third Reading.

. 1 Chapter 669. 732 which proposes a first of its kind Digital Advertising Gross Revenues Tax. This is a completely new tax with its own tax return.

The bills will now be sent to Governor Hogan for signature or veto. 732 2020 the Maryland Senate on February 12 2021 passed the nations. It is certain not to be the last.

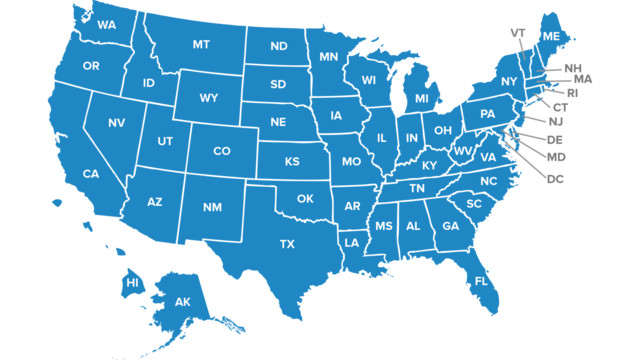

The legislature also passed HB. While some states and the District of Columbia have abandoned for now attempts to impose similar taxes several moresuch as Massachusetts New York Texas and West. House Bill 732 imposes a new tax on the gross revenues of a person derived from digital advertising services in Maryland.

FOR the purpose of exempting from a certain tax on certain annual gross revenues derived from certain digital. Digital Advertising Gross Revenues Tax Income Sales and UseExemption and Restriction and Tobacco Tax Taxes Alterations and Implementation. Digital advertising services Tax Alert Overview On February 12 2021 the Maryland Senate following the House of Delegates earlier in the week voted to override the veto of Governor Larry Hogan to House Bill 732 resulting in the enactment of a new gross revenues tax on digital advertising services in Maryland.

Instead of expanding the sales tax base to advertising services like DC below Maryland would have created an entirely new gross revenues tax on only digital advertising services display ads search engine ads mobile application ads and ads within a piece of software. For instance a company subject to the 10 rate having 100 million of revenue attributable to the performance of digital advertising services in Maryland would owe an annual tax of 10 million. Digital advertising services includes advertisement services on a digital interface including advertisements in the form of banner advertising search engine advertising interstitial advertising and other comparable advertising services.

The bill fast-tracked as the legislature seeks to wrap up its work raises. Senate Bill 787 AN ACT concerning. Applicability Date of Digital Advertising Gross Revenues Tax Delayed On April 12 2021 the General Assembly of Maryland passed Senate Bill 787 an Act concerning Digital Advertising Gross Revenues Income Sales and Use and Tobacco Taxes Alterations and Implementation.

Larry Hogan R vetoed a proposed first-in-the-nation digital advertising tax that would have imposed rates of up to 10 percent on digital advertising served to Marylanders. 932 which would expand Marylands sales tax to sales of digital products both downloads and streaming. Increasing certain tax rates on cigarettes and other tobacco products.

See SB 787 for more details. HOGAN JR Governor Ch. Wednesday March 17 2021.

1 day agoIn Marylands case the tax at issue is a four-tiered gross receipts tax on all revenue earned from digital advertising in the state even though traditional advertising revenue is. Imposing a sales and use tax rate of 12 on electronic smoking devices. Its expected to generate 250 million in its first year.

At that date the sales and use tax rate on a sale of a digital product or a digital code is 6. By Jason R. Earlier today the Maryland legislature passed HB.

Earlier today the Maryland Senate passed SB. By Charlie Kearns Charles Capouet on March 5 2021. The tax rate varied from 25 to.

Brown Kean Miller LLP New Orleans LA. Although the bill ostensibly targets large technology companies and advertising. But theres a new wrinkle to the continued debate an emergency bill filed by Senate President Bill Ferguson D-Baltimore City on Friday that he says will prevent tech giants from passing along an estimated 250 million tax on digital advertising to.

Taxation Tobacco Tax Sales and Use Tax and Digital Advertising Gross Revenues Tax. Lawmakers approved House Bill 732 in March 2020 but Governor Larry Hogan vetoed it. The statutory references contained in this publication are not effective until March 14 2021.

Posted in Digital Economy Policy and Legislation. Maryland has become the first state in the nation to impose a tax on digital advertising services. Overriding the governors veto of HB.

Heads to House of Delegates. 787 Digital Advertising Gross Revenues Tax and Tobacco Tax Alterations and Implementation on third. This tax is the first of its kind.

Requiring the Governor to include at least 18250000 in the annual budget for fiscal year 2022 and each fiscal year thereafter for. The Maryland Legislature has adopted the first digital advertising tax in the nation. In Maryland in a legislative process foreshortened and closed to the public due to the present public health crisis the legislature is on the verge of adopting a proposal originally conceived as a punitive measure against targeted advertising that quickly became a broader tax on digital advertising.

One of the provisions the Act states that the applicability of the Digital Advertising Gross.

The Fight Over Maryland S Digital Advertising Tax Part 1

Massachusetts Joins The Digital Advertising Tax Wave Salt Savvy

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

Will Digital Advertising Taxes Spread In 2021

Md Digital Advertising Tax Bill

Maryland Approves Country S First Tax On Big Tech S Ad Revenue The New York Times

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Enacts New Sales Tax On Digital Goods And Services Sc H Group

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Tax On Digital Advertising Services Enacted Kpmg United States

Maryland Attorney General S Office Says Taxpayers May Inform Customers Of Increased Charges Resulting From Digital Advertising Tax Mcdermott Will Emery Jdsupra

Maryland To Become First State To Tax Online Ads Sold By Facebook And Google Npr

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Digital Advertising Tax Litigation Focus Moves To State Courts

The Fight Over Maryland S Digital Advertising Tax Part 1

The Fight Over Maryland S Digital Advertising Tax Part 1

Maryland Digital Advertising Tax Regulations Tax Foundation Comments

Maryland Digital Advertising Tax Regulations Tax Foundation Comments